İşbank’s commitment to decarbonization: 2030 targets announced

In order to expedite the shift to a low-carbon economy and address the challenges posed by climate change, İşbank embraces an end-to-end business model, extending from fund procurement to delivering sustainable products and services to customers. The objective is to decrease emissions stemming from both İşbank's own operations and those associated with its customers and suppliers.

In aligning its sustainability initiatives and commitments with international standards, İşbank has committed to data-driven emission reduction targets as a signatory of the Net-Zero Banking Alliance, boasting 138 members across 44 countries and representing 41% of global banking assets.

Targets are guiding the green transformation of İşbank's customers

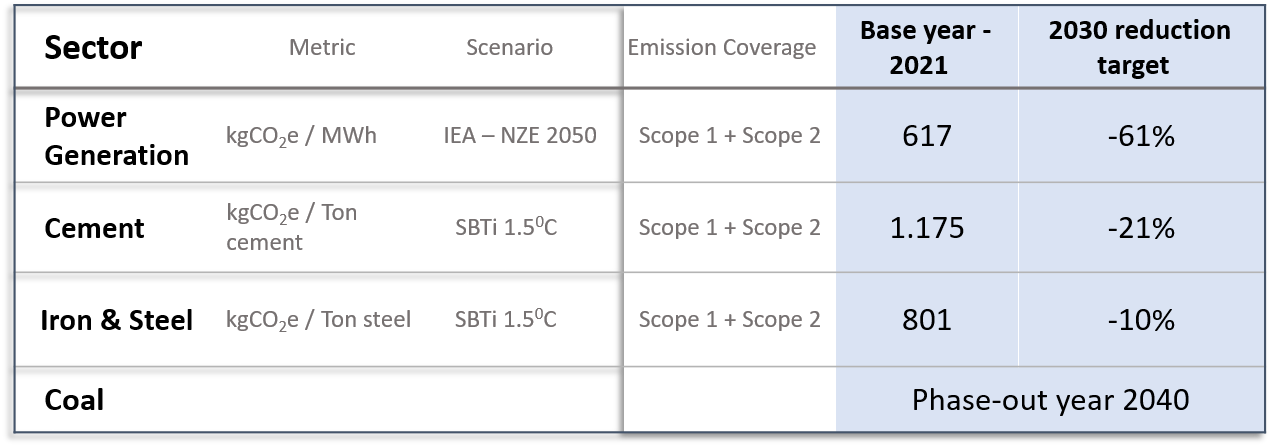

The Bank initially unveiled its 2030 targets for reducing emissions in the carbon-intensive sectors of power generation, cement, and iron and steel. Accordingly, the goal is to achieve a 61% reduction in emission intensity in the power generation sector, a 21% reduction in cement, and a 10% reduction in iron and steel by the year 2030, in comparison to the baseline year of 2021. The targets stand as a foundational component of the Bank's sustainability strategy, embodying its commitment to be a guiding business partner in facilitating the green transformation of its customers.

İşbank employed the Partnership for Carbon Accounting Financials (PCAF) methodology in formulating its targets within the identified sectors. The Bank extended its efforts beyond the initially identified sectors, conducting individualized studies with its customers to enhance the precision and quality of the data used in the calculations. In establishing sector-specific reduction targets anchored in baseline year values, İşbank considered science-based global scenarios.

“Our decarbonization targets are designed to support and finance the green transformation of our customers"

In his statement on the matter, İşbank CEO Hakan Aran underscored the ongoing acceleration of their climate change mitigation efforts, emphasizing that the Bank has established interim emission reduction targets for 2030, particularly in carbon-intensive sectors, aligning with their commitments within the framework of the Net-Zero Banking Alliance. Aran said, “These targets represent a significant step towards progressively reducing the carbon footprint of our loan portfolio. As we continue to analyze our loan portfolio for climate risks, we also assess climate change in terms of the opportunities it presents for green transformation. In this regard, we are committed to continuing our support and collaboration with our customers on their sustainability journeys. In addition to allocating a total of USD 6.8 billion to fund renewable energy projects, constituting a 77% share in our energy generation projects portfolio, we are dedicated to fostering the green transformation in the economy. To realize this commitment, we have introduced a TL 300 billion funding package for sustainable financing, extending until 2026.

As we approach the celebration of our Bank's centennial, sustainability will persist as one of our strategic priorities throughout our second century, because the world we inhabit is not an inheritance from our ancestors but a loan from our children and future generations. We all bear the responsibility of ensuring a sustainable world for future generations."

İşbank to cease coal financing by 2040

In a move to bolster the green transformation within the economy, İşbank has declared its intention to progressively phase out coal financing by the year 2040, alongside the intermediate targets set by the Net-Zero Banking Alliance. In 2020, the Bank has announced its commitment to refrain from financing new investments in coal and natural gas-based thermal power plants for electricity generation and pledged not to finance new coal mining activities in 2021. The targets, announced at the 28th Conference of the Parties (COP28) of the United Nations (UN) Framework Convention on Climate Change in Dubai, reaffirm the Bank's commitment and responsibility to provide transformative finance in the fight against climate change.

2030 Emission Reduction Targets for Identified Sectors

Note: The values in the table may be subject to change based on evolving methodologies and developments.

01.12.2023